# hide

# based on EnergyStorage_I_ANNO-2.ipynb

#no 1-hot encoding for the decision variable

#use the Bellman (with Backward Dynamic Programming) VFA policyIn Part 4 we also change the 1-hot encoding of the decision variable to something more scalable. We will have a single decision variable (\(x_{t,GB}\)) where a positive value indicates the amount bought, a negative value the amount sold, and a zero value when neither happened. The \(GB\) stands for ‘Grid-to-Battery’. When the flow is from grid to battery, \(x_{t,GB}\) will have a positive value. When the flow is reversed, i.e. battery to grid, \(x_{t,GB}\) will have a negative value. In the future, the number of decision variables will be increased as needed. Eventually we will have the decision vector:

\((x_{t,EL}, x_{t,EB}, x_{t,GL}, x_{t,GB}, x_{t,BL})\)

In Part 4 we explore again the Bellman policy - in the Value Function Approximation (VFA) class. This policy will be based on Bellman’s exact dynamic programming approach making use of Backward Dynamic Programming (BDP).

0 STRUCTURE & FRAMEWORK

The overall structure of this project and report follows the traditional CRISP-DM format. However, instead of the CRISP-DM’S “4 Modeling” section, we inserted the “6 step modeling process” of Dr. Warren Powell in section 4 of this document.

The example explored (but also modified) in this report comes from Dr. Warren Powell (formerly at Princeton). It was chosen as a template to create a POC for a client. It was important to understand this example thoroughly before embarking on creating the POC. Dr Powell’s unified framework shows great promise for unifying the formalisms of at least a dozen different fields. Using his framework enables easier access to thinking patterns in these other fields that might be beneficial and informative to the sequential decision problem at hand. Traditionally, this kind of problem would be approached from the reinforcement learning perspective. However, using Dr. Powell’s wider and more comprehensive perspective almost certainly provides additional value.

Here is information on Dr. Powell’s perspective on Sequential Decision Analytics.

The original code for this example can be found here.

In order to make a strong mapping between the code in this notebook and the mathematics in the unified framework, many variable names in the original code have been adapted. Here is a summary of the mapping between the mathematics and the variable names in the code:

- Superscripts

- variable names have a double underscore to indicate a superscript

- \(X^{\pi}\): has code

X__pi, is read X pi

- Subscripts

- variable names have a single underscore to indicate a subscript

- \(S_t\): has code

S_t, is read ‘S at t’ - \(M^{Spend}_t\) has code

M__Spend_twhich is read: “MSpend at t”

- Arguments

- collection variable names may have argument information added

- \(X^{\pi}(S_t)\): has code

X__piIS_tI, is read ‘X pi in S at t’ - the surrounding

I’s are used to imitate the parentheses around the argument

- Next time/iteration

- variable names that indicate one step in the future are quite common

- \(R_{t+1}\): has code

R_tt1, is read ‘R at t+1’ - \(R^{n+1}\): has code

R__nt1, is read ‘R at n+1’

- Rewards

- State-independent terminal reward and cumulative reward

- \(F\): has code

Ffor terminal reward - \(\sum_{n}F\): has code

cumFfor cumulative reward

- \(F\): has code

- State-dependent terminal reward and cumulative reward

- \(C\): has code

Cfor terminal reward - \(\sum_{t}C\): has code

cumCfor cumulative reward

- \(C\): has code

- State-independent terminal reward and cumulative reward

- Vectors where components use different names

- \(S_t(R_t, p_t)\): has code

S_t.R_tandS_t.p_t, is read ‘S at t in R at t, and, S at t in p at t’ - the code implementation is by means of a named tuple

self.State = namedtuple('State', SNames)for the ‘class’ of the vectorself.S_tfor the ‘instance’ of the vector

- \(S_t(R_t, p_t)\): has code

- Vectors where components reuse names

- \(x_t(x_{t,GB}, x_{t,BL})\): has code

x_t.x_t_GBandx_t.x_t_BL, is read ‘x at t in x at t for GB, and, x at t in x at t for BL’ - the code implementation is by means of a named tuple

self.Decision = namedtuple('Decision', xNames)for the ‘class’ of the vectorself.x_tfor the ‘instance’ of the vector

- \(x_t(x_{t,GB}, x_{t,BL})\): has code

- Use of mixed-case variable names

- to reduce confusion, sometimes the use of mixed-case variable names are preferred (even though it is not a best practice in the Python community), reserving the use of underscores and double underscores for math-related variables

1 BUSINESS UNDERSTANDING

The following business description comes from the free book by Dr. Powell, Sequential Decision Analytics and Modeling:

New Jersey is looking to develop 3,500 megawatts (MW) of offshore wind generating power. A challenge is that wind (and especially offshore wind) can be highly variable, due in part to the property that wind power (over intermediate ranges) increases with the cube of wind speed. This variability is depicted in figure 9.1, developed from a study of offshore wind. Energy from wind power has become popular in regions where wind is high, such as the midwestern United States, coastal regions off of Europe, the northeast of Brazil, and northern regions of China (to name just a few). Sometimes communities (and companies) have invested in renewables (wind or solar) to help reduce their carbon footprint and minimize their dependence on the grid. It is quite rare, however, that these projects allow a community to eliminate the grid from their portfolio. Common practice is to let the renewable source (wind or solar) sell directly to the grid, while a company may purchase from the grid. This can be useful as a hedge since the company will make a lot of money during price spikes (prices may jump from $20 per megawatt-hour (MWh) to $300 per MWh or more) that offsets the cost of purchasing power during those periods.

A challenge with renewables is handling the variability. While one solution is to simply pump any energy from a renewable source into the grid and use the tremendous power of the grid to handle this variability, there has been considerable interest in using storage (in particular, battery storage) to smooth out the peaks and valleys. In addition to handling the variability in the renewable source, there has also been interest in using batteries to take advantage of price spikes, buying power when it is cheap (prices can even go negative) and selling it back when they are high. Exploiting the variability in power prices on the grid is known as battery arbitrage.

This problem will provide insights into virtually any inventory/storage problem, including - Holding cash in mutual funds A bank has to determine how much of its investment capital to hold in cash to meet requests for redemptions, versus investing the money in loans, stocks and bonds. - Retailers (including both online as well as bricksandmortar stores) have to manage inventories of the hundreds of thousands of products. - Auto dealers have to decide how many cars to hold to meet customer demand. - Consulting firms have to decide how many employees to keep on staff to meet the variable demand of different consulting projects.

Energy storage is a particularly rich form of inventory problem.

2 DATA UNDERSTANDING

Next, we will start to look at the data that is provided for this problem.

#hide

from google.colab import drive

drive.mount('/content/gdrive', force_remount=True)

root_dir = "/content/gdrive/My Drive"

base_dir = root_dir + '/Powell/EnergyStorage_I'Mounted at /content/gdrive# import pdb

from collections import namedtuple, defaultdict

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

from copy import copy

import time

from scipy.ndimage.interpolation import shift

import pickle

from bisect import bisect

import math

from pprint import pprint

import matplotlib as mpl

pd.options.display.float_format = '{:,.4f}'.format

pd.set_option('display.max_columns', None)

pd.set_option('display.max_rows', None)

pd.set_option('display.max_colwidth', None)

! python --version

# 3.8.10; found it changed on 3/10/23Python 3.9.16DeprecationWarning: Please use `shift` from the `scipy.ndimage` namespace, the `scipy.ndimage.interpolation` namespace is deprecated.

from scipy.ndimage.interpolation import shiftdef process_raw_price_data(file, params):

DISC_TYPE = "FROM_CUM"

#DISC_TYPE = "OTHER"

print("Processing raw price data. Constructing price change list and cdf using {}".format(DISC_TYPE))

tS = time.time()

# load energy price data from the Excel spreadsheet

raw_data = pd.read_excel(file, sheet_name="Raw Data")

# look at data spanning a week

data_selection = raw_data.iloc[0:params['T'], 0:5]

# rename columns to remove spaces (otherwise we can't access them)

cols = data_selection.columns

cols = cols.map(lambda x: x.replace(' ', '_') if isinstance(x, str) else x)

data_selection.columns = cols

# sort prices in ascending order

sort_by_price = data_selection.sort_values('PJM_RT_LMP')

#print(sort_by_price.head())

hist_price = np.array(data_selection['PJM_RT_LMP'].tolist())

#print(hist_price[0])

max_price = pd.DataFrame.max(sort_by_price['PJM_RT_LMP'])

min_price = pd.DataFrame.min(sort_by_price['PJM_RT_LMP'])

print("Min price {:.2f} and Max price {:.2f}".format(min_price,max_price))

# sort prices in ascending order

sort_by_price = data_selection.sort_values('PJM_RT_LMP')

# calculate change in price and sort values of change in price in ascending order

data_selection['Price_Shift'] = data_selection.PJM_RT_LMP.shift(1)

data_selection['Price_Change'] = data_selection['PJM_RT_LMP'] - data_selection['Price_Shift']

sort_price_change = data_selection.sort_values('Price_Change')

# discretize change in price and obtain f(p) for each price change

max_price_change = pd.DataFrame.max(sort_price_change['Price_Change'])

min_price_change = pd.DataFrame.min(sort_price_change['Price_Change'])

print("Min price change {:.2f} and Max price change {:.2f}".format(min_price_change,max_price_change))

# there are 191 values for price change

price_changes_sorted = sort_price_change['Price_Change'].tolist()

# remove the last NaN value

price_changes_sorted.pop()

if DISC_TYPE == "FROM_CUM":

# discretize price change by interpolating from cumulative distribution

xp = price_changes_sorted

fp = np.arange(len(price_changes_sorted) - 1) / (len(price_changes_sorted) - 1)

cum_fn = np.append(fp, 1)

# obtain 30 discrete prices

discrete_price_change_cdf = np.linspace(0, 1, params['nPriceChangeInc'])

discrete_price_change_list = []

for i in discrete_price_change_cdf:

interpolated_point = np.interp(i, cum_fn, xp)

discrete_price_change_list.append(interpolated_point)

else:

price_change_range = max_price_change - min_price_change

price_change_increment = price_change_range / params['nPriceChangeInc']

discrete_price_change = np.arange(min_price_change, max_price_change, price_change_increment)

discrete_price_change_list = list(np.append(discrete_price_change, max_price_change))

f_p = np.arange(len(price_changes_sorted) - 1) / (len(price_changes_sorted) - 1)

cum_fn = np.append(f_p, 1)

discrete_price_change_cdf = []

for c in discrete_price_change_list:

interpolated_point = np.interp(c, price_changes_sorted, cum_fn)

discrete_price_change_cdf.append(interpolated_point)

price_changes_sorted = np.array(price_changes_sorted)

discrete_price_change_list = np.array(discrete_price_change_list)

discrete_price_change_cdf = np.array(discrete_price_change_cdf)

discrete_price_change_pdf = discrete_price_change_cdf - shift(discrete_price_change_cdf,1,cval=0)

mean_price_change = np.dot(discrete_price_change_list,discrete_price_change_pdf)

#print("discrete_price_change_list ", discrete_price_change_list)

#print("discrete_price_change_cdf", discrete_price_change_cdf)

#print("discrete_price_change_pdf", discrete_price_change_pdf)

print("Finishing processing raw price data in {:.2f} secs. Expected price change is {:.2f}. Hist_price len is {}".format(time.time()-tS,mean_price_change,len(hist_price)))

#input("enter any key to continue...")

exog_params = {

"hist_price": hist_price,

"price_changes_sorted": price_changes_sorted,

"discrete_price_change_list": discrete_price_change_list,

"discrete_price_change_cdf": discrete_price_change_cdf}

return exog_paramsseed = 189654913

file = 'Parameters.xlsx'# NOTE:

# R__max: unit is MWh which is an energy unit

# R_0: unit is MWh which is an energy unit

parDf = pd.read_excel(f'{base_dir}/{file}', sheet_name='ParamsModel', index_col=0); print(f'{parDf}')

# parDict = parDf.set_index('Index').T.to_dict('list')#.

parDict = parDf.T.to_dict('list') #.

params = {key:v for key, value in parDict.items() for v in value}

params['seed'] = seed

params['T'] = min(params['T'], 192); print(f'{params=}') 0

Index

Algorithm BackwardDP

T 195

eta 0.9000

R__max 1

R_0 1

params={'Algorithm': 'BackwardDP', 'T': 192, 'eta': 0.9, 'R__max': 1, 'R_0': 1, 'seed': 189654913}parDf = pd.read_excel(f'{base_dir}/{file}', sheet_name='GridSearch', index_col=0); print(parDf)

# parDict = parDf.set_index('Index').T.to_dict('list')#.

parDict = parDf.T.to_dict('list')

paramsPolicy = {key:v for key, value in parDict.items() for v in value}; print(f'{paramsPolicy=}')

params.update(paramsPolicy); pprint(f'{params=}') 0

Index

theta_sell_min 10

theta_sell_max 100

theta_buy_min 10

theta_buy_max 100

theta_inc 1

paramsPolicy={'theta_sell_min': 10, 'theta_sell_max': 100, 'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1}

("params={'Algorithm': 'BackwardDP', 'T': 192, 'eta': 0.9, 'R__max': 1, 'R_0': "

"1, 'seed': 189654913, 'theta_sell_min': 10, 'theta_sell_max': 100, "

"'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1}")parDf = pd.read_excel(f'{base_dir}/{file}', sheet_name='BackwardDP', index_col=0); print(parDf)

# parDict = parDf.set_index('Index').T.to_dict('list')#.

parDict = parDf.T.to_dict('list')

paramsPolicy = {key:v for key, value in parDict.items() for v in value}; print(f'{paramsPolicy=}')

params.update(paramsPolicy); pprint(f'{params=}') 0

Index

nPriceChangeInc 50

priceDiscSet 1, 0.5

run3D False

paramsPolicy={'nPriceChangeInc': 50, 'priceDiscSet': '1, 0.5', 'run3D': False}

("params={'Algorithm': 'BackwardDP', 'T': 192, 'eta': 0.9, 'R__max': 1, 'R_0': "

"1, 'seed': 189654913, 'theta_sell_min': 10, 'theta_sell_max': 100, "

"'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1, "

"'nPriceChangeInc': 50, 'priceDiscSet': '1, 0.5', 'run3D': False}")if isinstance(params['priceDiscSet'], str):

price_disc_list = params['priceDiscSet'].split(",")

price_disc_list = [float(e) for e in price_disc_list]

else:

price_disc_list = [float(params['priceDiscSet'])]

params['price_disc_list'] = price_disc_list; print(f'{price_disc_list=}')price_disc_list=[1.0, 0.5]pprint(f"{params=}")

#input("enter any key to continue...")("params={'Algorithm': 'BackwardDP', 'T': 192, 'eta': 0.9, 'R__max': 1, 'R_0': "

"1, 'seed': 189654913, 'theta_sell_min': 10, 'theta_sell_max': 100, "

"'theta_buy_min': 10, 'theta_buy_max': 100, 'theta_inc': 1, "

"'nPriceChangeInc': 50, 'priceDiscSet': '1, 0.5', 'run3D': False, "

"'price_disc_list': [1.0, 0.5]}")#exog_params is a dictionary with three lists:

# hist_price, price_changes_list, discrete_price_change_cdf

# exog_params = process_raw_price_data(f'{base_dir}/{file}', params)

exogParams = process_raw_price_data(f'{base_dir}/{file}', params) #.

# print(f"{exogParams['hist_price']=}")

# print(f"{exogParams['price_changes_sorted']=}")

# print(f"{exogParams['discrete_price_change_list']=}")

# print(f"{exogParams['discrete_price_change_cdf']=}")Processing raw price data. Constructing price change list and cdf using FROM_CUM

Min price 0.00 and Max price 107.34

Min price change -54.40 and Max price change 65.81

Finishing processing raw price data in 1.67 secs. Expected price change is 1.28. Hist_price len is 192print("Ingesting raw price data for understanding.")

# load energy price data from the Excel spreadsheet

raw_data = pd.read_excel(f'{base_dir}/{file}', sheet_name="Raw Data")

# look at data spanning a week

df_raw = raw_data.iloc[0:params['T'], 0:5]

# rename columns to remove spaces (otherwise we can't access them)

cols = df_raw.columns

cols = cols.map(lambda x: x.replace(' ', '_') if isinstance(x, str) else x)

df_raw.columns = cols

df_raw.head()Ingesting raw price data for understanding.| Time | Day | Hour | PJM_DA_LMP | PJM_RT_LMP | |

|---|---|---|---|---|---|

| 0 | 1.0000 | 2005-01-01 00:00:00 | 1.0000 | 25.7200 | 18.9100 |

| 1 | 2.0000 | 2005-01-01 01:00:00 | 2.0000 | 23.0800 | 14.2700 |

| 2 | 3.0000 | 2005-01-01 02:00:00 | 3.0000 | 21.0000 | 9.6700 |

| 3 | 4.0000 | 2005-01-01 03:00:00 | 4.0000 | 20.0000 | 17.6800 |

| 4 | 5.0000 | 2005-01-01 04:00:00 | 5.0000 | 20.0400 | 11.8800 |

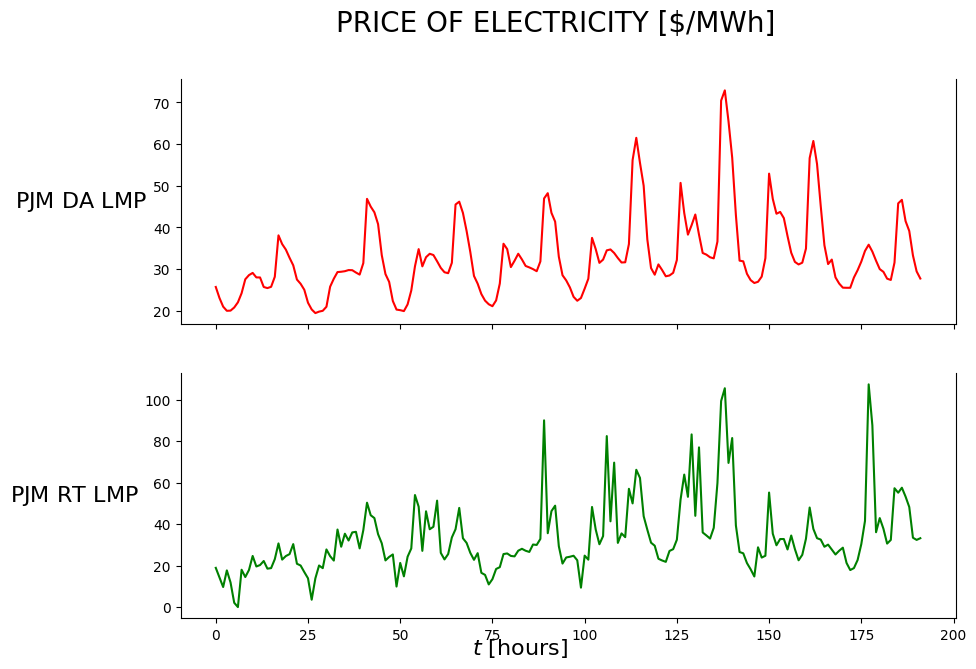

from certifi.core import where

def plot_data(df):

n_charts = 2

ylabelsize = 16

fig, axs = plt.subplots(n_charts, sharex=True)

fig.set_figwidth(10); fig.set_figheight(7)

fig.suptitle('PRICE OF ELECTRICITY [$/MWh]', fontsize=20)

i = 0

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(True)

axs[i].plot(df['PJM_DA_LMP'], 'r')

axs[i].set_ylabel('$\mathrm{PJM\ DA\ LMP}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

i = 1

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(True)

axs[i].plot(df['PJM_RT_LMP'], 'g')

axs[i].set_ylabel('$\mathrm{PJM\ RT\ LMP}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

axs[i].set_xlabel('$t\ \mathrm{[hours]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

plot_data(df_raw)

3 DATA PREPARATION

The most important aspect of data preparation will be to create an empirical distribution rather than to try and fit the data to a parametric distribution. This involves the computation of a cumulative distribution from the data. We first sort the prices from smallest to largest. Let this ordered sequence be represented by \(\tilde{p}_t\) where \(\tilde{p}_{t-1} \le \tilde{p}_t\). Also, let \(T\) be the number of time periods. The percentage of time periods with a price less than \(\tilde{p}_t\) is then \(t/T\). The empirical cumulative distribution is given by \[ F_P(\tilde{p}_t) = \frac{t}{T} \]

# hide

df_hist_price = pd.DataFrame({'hist_price': exogParams['hist_price']});

print(df_hist_price.shape)

# print(df_hist_price)

# df_hist_price.plot('hist_price');

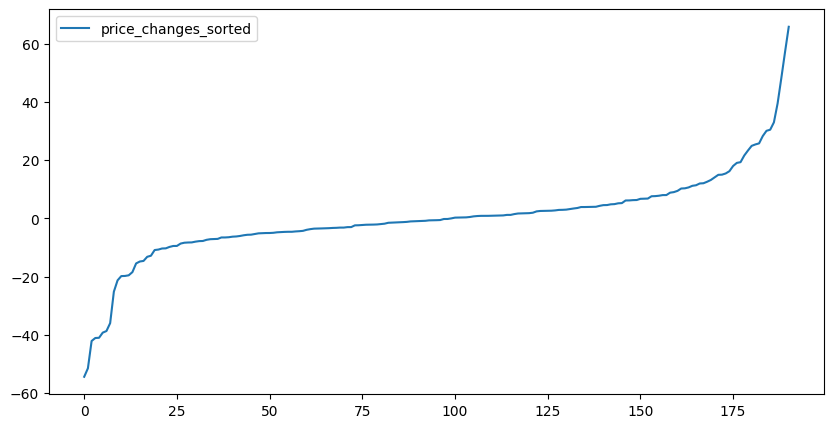

# df_hist_price.plot();(192, 1)df_price_changes_sorted = pd.DataFrame({'price_changes_sorted': exogParams['price_changes_sorted']});

print(df_price_changes_sorted.shape)

# print(df_price_changes_sorted)

df_price_changes_sorted.plot(figsize=(10,5));(191, 1)

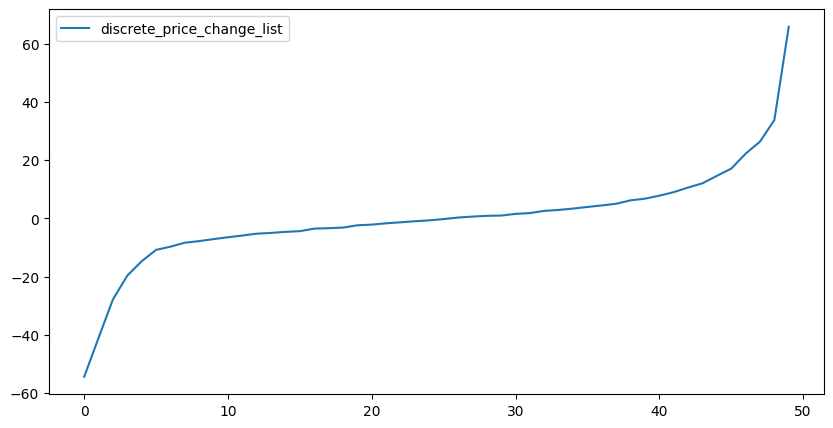

df_discrete_price_change_list = pd.DataFrame(

{'discrete_price_change_list': exogParams['discrete_price_change_list']})

print(df_discrete_price_change_list.shape)

# print(df_discrete_price_change_list)

df_discrete_price_change_list.plot(figsize=(10,5));(50, 1)

df_discrete_price_change_cdf = pd.DataFrame(

{'discrete_price_change_cdf': exogParams['discrete_price_change_cdf']})

print(df_discrete_price_change_cdf.shape)

# print(df_discrete_price_change_cdf)

# df_discrete_price_change_cdf.plot(figsize=(10,5));(50, 1)4 MODELING

4.1 Narrative

There has been an interest making use of batteries to exploit electricity price spikes. Power is bought when the price is low and power is sold when the price is high. This is known as battery arbitrage.

This project hightlights some interesting aspects of this kind of problem. Among these are:

- Electricity prices on the grid can be very volatile (varies between about $20/MWh to about $1,000/MWh or even $10,000/MWh for brief periods)

- Prices change every 5 minutes

- We assume that we can observe the price and then decide if we want to buy or sell

- We can only buy or sell for an entire 5-minute interval at a maximum rate of 0.01 MW

- Wind energy can be forecasted but not very well. Rolling forecasts can be used.

- Energy demand is variable but quite predictable. It depends on:

- temperature (primarily)

- humidity (less)

- Energy may be bought from or sold to the grid at current grid prices.

- There is a 5% to 10% loss when converting power from AC (grid) to DC (to store in battery).

4.2 Core Elements

This section attempts to answer three important questions: - What metrics are we going to track? - What decisions do we intend to make? - What are the sources of uncertainty?

For this problem, the only metric we are interested in is the amount of profit we make after each decision window. A single type of decision needs to be made at the start of each window - how much energy to buy or sell. The only source of uncertainty is the price of energy.

4.3 Mathematical Model | SUM Design

A Python class is used to implement the model for the SUM (System Under Management):

class EnergyStorageModel():

def __init__(

self, SVarNames, xVarNames, S_0, params, exogParams, possibleDecisions,

W_fn=None, S__M_fn=None, C_fn=None):

...

...4.3.1 State variables

The state variables represent what we need to know.

- \(R_t\)

- amount of energy stored in the battery at time \(t\)

- measured in kWh or MWh

- \(p_t\)

- price of energy on the grid

The state is:

\(S_t = (R_t,p_t)\)

The state variables are represented by the following variables in the EnergyStorageModel class:

self.SVarNames = SVarNames

self.State = namedtuple('State', SVarNames) # 'class'

self.S_t = self.build_state(self.S_0) # 'instance'where

SVarNames = ['R_t', 'p_t']4.3.2 Decision variables

The decision variables represent what we control.

- \(x_t\)

- amount of energy bought from (\(x_t>0\)) or sold to (\(x_t<0\)) the grid

- Losses

- When energy is transferred to or from the battery a loss is incurred

- Assume the loss into the battery is the same as the loss out of the battery

- \(\eta\) is the fraction of the energy retained

- \(1 - \eta\) is the loss

- Constraints

- buy from grid \((x_t>0)\):

- \(x_t \le \frac{1}{\eta}(R^{max} - R_t)\)

- sell to grid \((x_t<0)\):

- \(-x_t \le R_t\), which comes to

- \(x_t \ge -R_t\)

- buy from grid \((x_t>0)\):

- Decisions are made with a policy (TBD below):

- \(X^{\pi}(S_t)\)

The decision variables are represented by the following variables in the EnergyStorageModel class:

self.Decision = namedtuple('Decision', xVarNames) # 'class'where

xVarNames = ['x_t_EL', 'x_t_EB', 'x_t_GL', 'x_t_GB', 'x_t_BL']NOTE: For now, we will only use a single decision variable, ‘x_t_GB’. In the future the complete list will be used. In this notebook we will start to move away from the 1-hot representation.

4.3.3 Exogenous information variables

The exogenous information variables represent what we did not know (when we made a decision). These are the variables that we cannot control directly. The information in these variables become available after we make the decision \(x_t\).

When we assume that the price in each time period is revealed, without any model to predict the price based on past prices, we have:

\[ W_{t+1} = p_{t+1} \]

Alternatively, when we assume that we observe the change in price \(\hat{p}=p_t-p_{t-1}\), we have:

\[ W_{t+1} = \hat{p}_{t+1} \]

The exogenous information have been preprocessed and is captured in:

exogParams['hist_price']exogParams['price_changes_sorted']exogParams['discrete_price_change_list']exogParams['discrete_price_change_cdf']

The latest exogenous information can be accesses by calling the following method from class EnergyStorageModel():

def W_fn(self, t):

W_tt1 = self.exogParams['hist_price'][t]

return W_tt14.3.4 Transition function

The transition function describe how the state variables evolve over time. Because we currently have two state variables in the state, \(S_t=(R_t,p_t)\), we have the equations:

\[ \begin{aligned} R_{t+1} &= R_t + \eta x_t \\ p_{t+1} &= p_t + \hat{p}_{t+1} \end{aligned} \]

Collectively, they represent the general transition function:

\[ S_{t+1} = S^M(S_t,X^{\pi}(S_t)) \]

The transition function is implemented by the following method in class EnergyStorageModel():

def S__M_fn(self, t, x_t): #.

p_tt1 = self.W_fn(t)

R_tt1 = self.S_t.R_t + x_t.x_t_GB

if len(self.SVarNames) == 2:

S_tt1 = self.build_state({'R_t': R_tt1, 'p_t': p_tt1})

elif len(self.SVarNames) == 3:

S_tt1 = self.build_state({'R_t': R_tt1, 'p_t': p_tt1, 'p_t_1': self.S_t.p_t})

return S_tt14.3.5 Objective function

The objective function captures the performance metrics of the solution to the problem. It is given by:

\[ \max_{\pi} \mathbb{E} \sum_{t=0}^T C(S_t,x_t) \]

where \[ C(S_t,x_t) = -p_tx_t \]

The contribution (reward) function is implemented by the following method in class EnergyStorageModel():

def C_fn(self, x_t):

C_t = self.S_t.p_t*( -self.initArgs['eta']*x_t.x_t_GB )#. C(S_t, x_t, W_t+1); x_t_GB>0 for buy, <0 for sell

return C_t4.3.6 Implementation of SUM Model

Here is the complete implementation of the EnergyStorageModel class:

class EnergyStorageModel():

def __init__(

self, SVarNames, xVarNames, S_0, params, exogParams, possibleDecisions,

W_fn=None, S__M_fn=None, C_fn=None):

self.initArgs = params

self.prng = np.random.RandomState(params['seed'])

self.exogParams = exogParams

self.S_0 = S_0

self.SVarNames = SVarNames

self.xVarNames = xVarNames

self.possibleDecisions = possibleDecisions

self.State = namedtuple('State', SVarNames) # 'class'

self.S_t = self.build_state(self.S_0) # 'instance'

self.Decision = namedtuple('Decision', xVarNames) # 'class'

self.cumC = 0.0 #. cumulative reward; use F or cumF for final (i.e. no cumulative) reward

# self.states = [self.S_t] # keep a list of states visited

def reset(self):

self.cumC = 0.0

self.S_t = self.build_state(self.S_0)

# self.states = [self.S_t]

def build_state(self, info):

return self.State(*[info[sn] for sn in self.SVarNames])

def build_decision(self, info):

return self.Decision(*[info[xn] for xn in self.xVarNames])

def W_fn(self, t):

W_tt1 = self.exogParams['hist_price'][t]

return W_tt1

def S__M_fn(self, t, x_t): #.

p_tt1 = self.W_fn(t)

R_tt1 = self.S_t.R_t + x_t.x_t_GB

if len(self.SVarNames) == 2:

S_tt1 = self.build_state({'R_t': R_tt1, 'p_t': p_tt1})

elif len(self.SVarNames) == 3:

S_tt1 = self.build_state({'R_t': R_tt1, 'p_t': p_tt1, 'p_t_1': self.S_t.p_t})

return S_tt1

def C_fn(self, x_t):

C_t = self.S_t.p_t*( -self.initArgs['eta']*x_t.x_t_GB )#. C(S_t, x_t, W_t+1); x_t_GB>0 for buy, <0 for sell

return C_t

def step(self, t, x_t):

self.cumC += self.C_fn(x_t)

self.S_t = self.S__M_fn(t, x_t)

return (self.S_t, self.cumC, x_t) #. for plotting4.4 Uncertainty Model

As mentioned above in section 3, we make use of an empirical distribution rather than to try and fit the data to a parametric distribution. This involves the computation of a cumulative distribution from the data. We first sort the prices from smallest to largest. Let this ordered sequence be represented by \(\tilde{p}_t\) where \(\tilde{p}_{t-1} \le \tilde{p}_t\). Also, let \(T\) be the number of time periods. The percentage of time periods with a price less than \(\tilde{p}_t\) is then \(t/T\). The empirical cumulative distribution is given by \[ F_P(\tilde{p}_t) = \frac{t}{T} \]

4.5 Policy Design

There are two main meta-classes of policy design. Each of these has two subclasses: - Policy Search - Policy Function Approximations (PFAs) - Cost Function Approximations (CFAs) - Lookahead - Value Function Approximations (VFAs) - Direct Lookaheads (DLAs)

In this project we will use: - A Belmann type policy, making use of Backward Dynamic Programming (BDP). This policy falls in the VFA class.

The Belmann policy is implemented by the following method in class EnergyStoragePolicy():

def X__bellman(self, t, S_t, bellmanModel, T): #. SDAM-9.4.2

info = {

'x_t_EL': 0, #Wind to Load ('EC': Wind to Consumer)

'x_t_EB': 0, #Wind to Battery ('WS': Wind to Storage)

'x_t_GL': 0, #Grid to Load ('GC': Grid to Consumer)

'x_t_GB': 0, #Grid to Battery ('GS': Grid to Storage); can be negative to reverse flow (sell back to Grid)

'x_t_BL': 0, #Battery to Load ('SC': Storage to Consumer)

}

p_t = S_t.p_t

R_t = S_t.R_t

print(f'X_bellman invocation: {R_t=:.2f}, {p_t=:.2f}')

vMax = -np.inf

dMax = None

for d in self.model.possibleDecisions: #. for each x_t, relates to discrete_energy, R_t

C_t = S_t.p_t*( -self.model.initArgs['eta']*d )#. C(S_t, x_t, W_t+1); x_t_GB>0 for buy, <0 for sell

Sum_w = 0

w_idx = 0

for w in bellmanModel.discretePriceChanges: #. for each w

f__W = bellmanModel.f_p[w_idx] if w_idx == 0 else bellmanModel.f_p[w_idx] - bellmanModel.f_p[w_idx - 1]

S_tt1 = bellmanModel.S__M(S_t, d, w)

try:

V_tt1 = bellmanModel.V_tIS_tI[t+1][S_tt1] if t < bellmanModel.time else bellmanModel.terminalContribution

except KeyError as ke:

# print(f'Key {ke} Not Found in V_tIS_tI[{t + 1}][{S_tt1}]')

V_tt1 = 1_000.0

Sum_w += f__W*V_tt1

w_idx += 1

v = C_t + Sum_w

print(f' {d=}, {v=:.0f}, {vMax=:.0f}, {dMax=}')

if (v > vMax):

print(f' {v=:.0f} is greater than {vMax=:.0f}')

vMax = v; print(f' new {vMax=:.0f}')

dMax = d; print(f' new {dMax=}')

if dMax > 0: #BUY

info['x_t_GB'] = min(dMax, (self.model.initArgs['R__max'] - S_t.R_t)/self.model.initArgs['eta'])

elif dMax < 0: #SELL

info['x_t_GB'] = max(-S_t.R_t, dMax) #sell the whole inventory

else:

print(f'### {dMax=}')

info['x_t_GB'] = 0.0 #HOLD

return self.model.build_decision(info)4.5.1 Implementation of Policy Design

The EnergyStoragePolicy() class implements the policy design.

import random

class EnergyStoragePolicy():

def __init__(self, model, piNames):

self.model = model

self.piNames = piNames

self.Policy = namedtuple('Policy', piNames)

def X__bellman(self, t, S_t, bellmanModel, T): #. SDAM-9.4.2

info = {

'x_t_EL': 0, #Wind to Load ('EC': Wind to Consumer)

'x_t_EB': 0, #Wind to Battery ('WS': Wind to Storage)

'x_t_GL': 0, #Grid to Load ('GC': Grid to Consumer)

'x_t_GB': 0, #Grid to Battery ('GS': Grid to Storage); can be negative to reverse flow (sell back to Grid)

'x_t_BL': 0, #Battery to Load ('SC': Storage to Consumer)

}

p_t = S_t.p_t

R_t = S_t.R_t

# print(f'X_bellman invocation: {R_t=:.2f}, {p_t=:.2f}')

vMax = -np.inf

dMax = None

for d in self.model.possibleDecisions: #. for each x_t, relates to discrete_energy, R_t

C_t = S_t.p_t*( -self.model.initArgs['eta']*d )#. C(S_t, x_t, W_t+1); x_t_GB>0 for buy, <0 for sell

Sum_w = 0

w_idx = 0

for w in bellmanModel.discretePriceChanges: #. for each w

f__W = bellmanModel.f_p[w_idx] if w_idx == 0 else bellmanModel.f_p[w_idx] - bellmanModel.f_p[w_idx - 1]

S_tt1 = bellmanModel.S__M(S_t, d, w)

try:

V_tt1 = bellmanModel.V_tIS_tI[t+1][S_tt1] if t < bellmanModel.time else bellmanModel.terminalContribution

except KeyError as ke:

# print(f'Key {ke} Not Found in V_tIS_tI[{t + 1}][{S_tt1}]')

V_tt1 = 1_000.0

Sum_w += f__W*V_tt1

w_idx += 1

v = C_t + Sum_w

# print(f' {d=}, {v=:.0f}, {vMax=:.0f}, {dMax=}')

if (v > vMax):

# print(f' {v=:.0f} is greater than {vMax=:.0f}')

vMax = v; #print(f' new {vMax=:.0f}')

dMax = d; #print(f' new {dMax=}')

if dMax > 0: #BUY

info['x_t_GB'] = min(dMax, (self.model.initArgs['R__max'] - S_t.R_t)/self.model.initArgs['eta'])

elif dMax < 0: #SELL

info['x_t_GB'] = max(-S_t.R_t, dMax) #sell the whole inventory

else:

# print(f'### {dMax=}')

info['x_t_GB'] = 0.0 #HOLD

return self.model.build_decision(info)

def X__bellman_random(self, t, S_t, bellmanModel, T): #. SDAM-9.4.2

info = {

'x_t_EL': 0, #Wind to Load ('EC': Wind to Consumer)

'x_t_EB': 0, #Wind to Battery ('WS': Wind to Storage)

'x_t_GL': 0, #Grid to Load ('GC': Grid to Consumer)

'x_t_GB': 0, #Grid to Battery ('GS': Grid to Storage); can be negative to reverse flow (sell back to Grid)

'x_t_BL': 0, #Battery to Load ('SC': Storage to Consumer)

}

p_t = S_t.p_t #price

R_t = S_t.R_t #energy_amount

dMax = random.choice(self.model.possibleDecisions); #print(f'X__bellman_random: {dMax=}')

if dMax > 0: #BUY

info['x_t_GB'] = (self.model.initArgs['R__max'] - S_t.R_t)/self.model.initArgs['eta']

elif dMax < 0: #SELL

info['x_t_GB'] = -S_t.R_t #sell the whole inventory

else:

info['x_t_GB'] = 0.0

return self.model.build_decision(info)

def run_policy(self, piInfo, piName, params):

model_copy = copy(self.model)

T = params['T']

# nTrades = {'buy': 0, 'sell': 0, 'hold': 0}

# nTrades = {'x_t_buy': 0, 'x_t_sell': 0, 'x_t_hold': 0}

buyList = []

sellList = []

for t in range(T):

x_t = getattr(self, piName)(t, model_copy.S_t, piInfo, T)

# nTrades['x_t_buy'] += x_t.x_t_buy; #print(f'!!!!! {x_t.buy=}')

# nTrades['x_t_sell'] += x_t.x_t_sell; #print(f'!!!!! {x_t.sell=}')

# nTrades['x_t_hold'] += model_copy.S_t.R_t#.

# if x_t.x_t_buy > 0:

if x_t.x_t_GB > 0:

buyList.append((t, model_copy.S_t.R_t, model_copy.S_t.p_t, x_t.x_t_GB, params['R__max']))

elif x_t.x_t_GB < 0:

sellList.append((t, model_copy.S_t.R_t, model_copy.S_t.p_t, x_t.x_t_GB, params['R__max']))

_, _, _ = model_copy.step(t, x_t) # step the model forward one iteration

cumC = model_copy.cumC #.

# print(f"Energy traded - Sell: {nTrades['x_t_sell']:.2f} - Buy: {nTrades['x_t_buy']:.2f} - Hold % : {nTrades['x_t_hold']/model_copy.init_args['T']:.2f}") #.

# print(f"Energy traded - Buy: {nTrades['x_t_buy']:.2f} - Hold: {nTrades['x_t_hold']:.2f} - Sell: {nTrades['x_t_sell']:.2f}")

# print("Buy times and prices ")

# for i in range(len(buy_list)):

# print(f"t = {buy_list[i][0]:.2f} and price = {buy_list[i][1]:.2f}") #.

# print("Sell times and prices ")

# for i in range(len(sell_list)):

# print(f"t = {sell_list[i][0]:.2f} and price = {sell_list[i][1]:.2f}") #.

return cumC

def run_policy_sample_paths(self, theta, piName, params):

FhatIomega__lI = []

for l in range(1, params['L'] + 1):

model_copy = copy(self.model)

record_l = [piName, theta, l]

T = params['T']

# nTrades = {'x_t_buy': 0, 'x_t_sell': 0, 'x_t_hold': 0}

buyList = []

sellList = []

for t in range(T):

x_t = getattr(self, piName)(t, model_copy.S_t, theta, params['T'])

# nTrades['x_t_buy'] += x_t.x_t_buy; #print(f'!!!!! {x_t.buy=}')

# nTrades['x_t_sell'] += x_t.x_t_sell; #print(f'!!!!! {x_t.sell=}')

# nTrades['x_t_hold'] += model_copy.S_t.R_t

# if x_t.x_t_buy > 0:

if x_t.x_t_GB > 0:

buyList.append((t, model_copy.S_t.R_t, model_copy.S_t.p_t, x_t.x_t_GB, params['R__max']))

elif x_t.x_t_GB < 0:

sellList.append((t, model_copy.S_t.R_t, model_copy.S_t.p_t, x_t.x_t_GB, params['R__max']))

_, _, _ = model_copy.step(t, x_t)

FhatIomega__lI.append(model_copy.cumC) #. just above (SDAM-eq2.9) #. Fhat for this sample-path is in model_copy.cumC

# print(f"Inventory traded - Buy: {nTrades['x_t_buy']:.2f} - Hold: {nTrades['x_t_hold']:.2f} - Sell: {nTrades['x_t_sell']:.2f}")

# print("Buy times ")

# for i in range(len(buy_list)):

# print(f"t={buy_list[i][0]}, R_t={buy_list[i][1]:.2f}, D_t={buy_list[i][2]:.2f}, x_t.x_t_buy={buy_list[i][3]:.2f}, R__max={buy_list[i][4]:.2f}")

# print("Sell times ")

# for i in range(len(sell_list)):

# print(f"t={sell_list[i][0]}, R_t={sell_list[i][1]:.2f}, D_t={sell_list[i][2]:.2f}, x_t.x_t_sell={sell_list[i][3]:.2f}, R__max={buy_list[i][4]:.2f}")

# return cumC

# end L

return FhatIomega__lI

def perform_bellman_search(self, params, discreteEnergy, minPrice, maxPrice, incValues):

tS = time.time()

cumCI_inc_I = {}

bdpI_inc_I = {}

best_inc = -np.inf

best_cumC = -np.inf

best_bdp = None

for inc in incValues: #for each discretization

discretePrices = np.arange(minPrice, maxPrice + inc, inc)

print(f"\nStarting BackwardDP 2D for price discretization with inc={inc}")

test_2D_bdp = BDP(

discretePrices=discretePrices,

discreteEnergy=discreteEnergy,

priceChanges=exogParams['price_changes_sorted'],

discretePriceChanges=exogParams['discrete_price_change_list'],

f_p=exogParams['discrete_price_change_cdf'],

stop_time=params['T'],

model=copy(M))

# 2D states - time the process with a 2D state variable

t0 = time.time()

V_tIS_tI = test_2D_bdp.bellman()

t1 = time.time()

time_elapsed = t1 - t0

print("Time_elapsed_2D_model={:.2f} secs.".format(time_elapsed))

print("Starting policy evaluation for the actual sample path")

tS = time.time()

cumC = self.run_policy(test_2D_bdp, "X__bellman", params)

cumCI_inc_I[inc] = cumC

bdpI_inc_I[inc] = test_2D_bdp

if(cumC > best_cumC):

best_cumC = cumC

best_inc = inc

best_bdp = test_2D_bdp

print(f"Finishing inc {inc} with cumC {cumC:.2f}. Best inc so far {best_inc}. Best cumC {cumCI_inc_I[best_inc]:.2f}")

print(f"Finishing BellmanSearch in {time.time() - tS:.2f} secs")

print(f"Best inc: {best_inc}. Best cumC {cumCI_inc_I[best_inc]:.2f}")

return cumCI_inc_I, best_bdp, bdpI_inc_I

def plot_heat_map(self, contribution_dict, theta_buy_values, theta_sell_values):

contribution_values = [contribution_dict[(theta_buy,theta_sell)] for theta_sell in theta_sell_values for theta_buy in theta_buy_values]

contributions = np.array(contribution_values)

increment_count = len(theta_buy_values)

contributions = np.reshape(contributions, (-1, increment_count))

fig, ax = plt.subplots()

im = ax.imshow(contributions, cmap='hot',origin='lower',aspect='auto')

# create colorbar

cbar = ax.figure.colorbar(im, ax=ax)

# cbar.ax.set_ylabel(cbarlabel, rotation=-90, va="bottom")

# we want to show all ticks...

ax.set_xticks(np.arange(0,len(theta_buy_values),5))

ax.set_yticks(np.arange(0,len(theta_sell_values),5))

# ... and label them with the respective list entries

ax.set_xticklabels(theta_buy_values[::5])

ax.set_yticklabels(theta_sell_values[::5])

# rotate the tick labels and set their alignment.

#plt.setp(ax.get_xticklabels(), rotation=45, ha="right",rotation_mode="anchor")

ax.set_title("Heatmap of contribution values across different values of theta")

ax.set_ylabel('Theta sell high values')

ax.set_xlabel('Theta buy low values')

#fig.tight_layout()

plt.show()

return Trueclass BDP(): #. SDAM-9.4.2: Backward Dynamic Programming; SDAM-fig9.6; RLSO-fig14.3

def __init__(self, discretePrices, discreteEnergy, priceChanges, discretePriceChanges,

f_p, stop_time, model):

self.discreteEnergy = discreteEnergy

self.discretePrices = discretePrices

self.priceChanges = priceChanges

self.discretePriceChanges = discretePriceChanges

self.f_p = f_p

self.time = stop_time - 1

self.model = model

self.terminalContribution = 0

self.V_tIS_tI = None #this will store the vfas - it will be computed by the method bellman_2D or bellman_3D

def S__M(self, S_t, x_t, exogInfo):

R_tt1 = self.model.S_t.R_t + self.model.initArgs['eta']*x_t #. x_t here is number

R_tt1_adjusted = math.ceil(R_tt1)

if len(S_t) == 2:

p_tt1 = S_t.p_t + exogInfo

elif len(S_t) == 3:

p_tt1 = 0.5*S_t.p_t_1 + 0.5*S_t.p_t + exogInfo

if p_tt1 <= min(self.discretePrices):

p_tt1_adjusted = min(self.discretePrices)

elif p_tt1 >= max(self.discretePrices):

p_tt1_adjusted = max(self.discretePrices)

else:

index = bisect(self.discretePrices, p_tt1)

p_tt1_adjusted = self.discretePrices[index]

if len(S_t) == 2:

S_tt1 = self.model.build_state({'R_t': R_tt1_adjusted, 'p_t': p_tt1_adjusted})

elif len(S_t) == 3:

p_t = S_t.p_t

if p_t <= min(self.discretePrices):

p_t_adjusted = min(self.discretePrices)

elif p_t >= max(self.discretePrices):

p_t_adjusted = max(self.discretePrices)

else:

index = bisect(self.discretePrices, p_t)

p_t_adjusted = self.discretePrices[index]

S_tt1 = self.model.build_state({

'R_t': R_tt1_adjusted,

'p_t': p_tt1_adjusted,

'p_t_1': p_t_adjusted

})

return S_tt1

def bellman(self):

# make list of all possible 2D states using discretized values

self.possibleStates = []

if len(self.model.SVarNames) == 2:

for price in self.discretePrices:

for energy in self.discreteEnergy:

S_t = self.model.build_state({'R_t': energy, 'p_t': price})

self.possibleStates.append(S_t)

else:

for p in self.discretePrices:

for prev_p in self.discretePrices:

for energy in self.discreteEnergy:

S_t = self.model.build_state({'R_t': energy, 'p_t': p, 'p_t_1': prev_p})

self.possibleStates.append(S_t)

print("State dimension: {}. State space size: {}. Exogenous info size: {}".format(len(self.model.SVarNames),len(self.possibleStates),len(self.discretePriceChanges)))

print(f'{self.discretePrices=}')

print(f'{self.discreteEnergy=}')

# print(f'{self.possibleStates=}')

t = self.time

V_tIS_tI = defaultdict(dict)

while t != -1: #. for each t

if t%10 == 0: print(f'{t}')

maxDict = {}

for S_t in self.possibleStates: #. for each S_t

p_t = S_t.p_t

R_t = S_t.R_t

vList = []

for d in self.model.possibleDecisions: #. for each x_t

C_t = S_t.p_t*( -self.model.initArgs['eta']*d )#. C(S_t, x_t, W_t+1); x_t_GB>0 for buy, <0 for sell

Sum_w = 0 #.

w_idx = 0

for w in self.discretePriceChanges: #. for each w

f__W = self.f_p[w_idx] if w_idx == 0 else self.f_p[w_idx] - self.f_p[w_idx - 1]

S_tt1 = self.S__M(S_t, d, w); #print(f'###{next_state=}') #.

try:

V_tt1 = V_tIS_tI[t + 1][S_tt1] if t < self.time else self.terminalContribution

except KeyError as ke:

V_tt1 = 0.0

Sum_w += f__W*V_tt1

w_idx += 1

v = C_t + Sum_w

vList.append(v)

maxValue = max(vList)

maxDict.update({S_t: maxValue}) #.

V_tIS_tI[t] = maxDict

t -= 1

pass

self.V_tIS_tI = V_tIS_tI

return V_tIS_tI4.6 Evaluating Policies

4.6.1 Training/Tuning

# UPDATE PARAMETERS

params.update({'Algorithm': 'BackwardDP'})

params.update({'price_disc_list': [1.0, 0.5]})

params.update({'R__max': 1})

params{'Algorithm': 'BackwardDP',

'T': 192,

'eta': 0.9,

'R__max': 1,

'R_0': 1,

'seed': 189654913,

'theta_sell_min': 10,

'theta_sell_max': 100,

'theta_buy_min': 10,

'theta_buy_max': 100,

'theta_inc': 1,

'nPriceChangeInc': 50,

'priceDiscSet': '1, 0.5',

'run3D': False,

'price_disc_list': [1.0, 0.5]}# create a model and a policy

piNames = ['X__bellman']

SVarNames = ['R_t', 'p_t']

initialState = {

'R_t': params['R_0'],

'p_t': exogParams['hist_price'][0],

}

xVarNames = ['x_t_EL', 'x_t_EB', 'x_t_GL', 'x_t_GB', 'x_t_BL']

possibleDecisions = [-1., 0, 1.]

M = EnergyStorageModel(

SVarNames,

xVarNames,

initialState,

params,

exogParams,

possibleDecisions

)

P = EnergyStoragePolicy(M, piNames)params['price_disc_list'][1.0, 0.5]%%time

#################################################################################

#BackwardDP

if params['Algorithm'] == 'BackwardDP':

#Constructing the state space

# make list of possible energy amount stored at a time

discreteEnergy = np.array([0., 1.])

# make list of prices with different increments

minPrice = np.min(exogParams['hist_price'])

maxPrice = np.max(exogParams['hist_price'])

# incValues = params['price_disc_list']

incValues = [1.0]

cumCI_inc_I, best_bdp, bdpI_inc_I = \

P.perform_bellman_search(

params, discreteEnergy, minPrice, maxPrice, incValues)

# #########################################################################

# SUMMARY

# P.perform_bellman_search()

# for inc in inc_values: #for each discretization

# test_2D_bdp.bellman()|bellman_1hot()

# while t != -1: #. for each t

# for S_t in self.possible_states: #. for each S_t

# for d in self.model.possible_decisions: #. for each x_t

# for w in self.discrete_price_changes: #. for each w

# return V_tIS_tI

# return cumCI_inc_I, best_bdp, bdpI_inc_I

Starting BackwardDP 2D for price discretization with inc=1.0

State dimension: 2. State space size: 218. Exogenous info size: 50

self.discretePrices=array([ 0., 1., 2., 3., 4., 5., 6., 7., 8., 9., 10.,

11., 12., 13., 14., 15., 16., 17., 18., 19., 20., 21.,

22., 23., 24., 25., 26., 27., 28., 29., 30., 31., 32.,

33., 34., 35., 36., 37., 38., 39., 40., 41., 42., 43.,

44., 45., 46., 47., 48., 49., 50., 51., 52., 53., 54.,

55., 56., 57., 58., 59., 60., 61., 62., 63., 64., 65.,

66., 67., 68., 69., 70., 71., 72., 73., 74., 75., 76.,

77., 78., 79., 80., 81., 82., 83., 84., 85., 86., 87.,

88., 89., 90., 91., 92., 93., 94., 95., 96., 97., 98.,

99., 100., 101., 102., 103., 104., 105., 106., 107., 108.])

self.discreteEnergy=array([0., 1.])

190

180

170

160

150

140

130

120

110

100

90

80

70

60

50

40

30

20

10

0

Time_elapsed_2D_model=139.93 secs.

Starting policy evaluation for the actual sample path

Finishing inc 1.0 with cumC 87.48. Best inc so far 1.0. Best cumC 87.48

Finishing BellmanSearch in 0.55 secs

Best inc: 1.0. Best cumC 87.48

CPU times: user 2min 18s, sys: 317 ms, total: 2min 18s

Wall time: 2min 20scumCI_inc_I{1.0: 87.48}best_bdp<__main__.BDP at 0x7f78e9412d30>4.6.2 Evaluation

params['R_0']1# create a model and a policy

piNames = ['X__bellman']

SNames = ['R_t', 'p_t']

initialState = {

# 'R_t': params['R_0'],

'R_t': 1,

'p_t': exogParams['hist_price'][0],

}

xVarNames = ['x_t_EL', 'x_t_EB', 'x_t_GL', 'x_t_GB', 'x_t_BL']

possibleDecisions = M.possibleDecisions

M_evalu = EnergyStorageModel(

SVarNames,

xVarNames,

initialState,

params,

exogParams,

possibleDecisions

)

P_evalu = EnergyStoragePolicy(M_evalu, piNames)

params{'Algorithm': 'BackwardDP',

'T': 192,

'eta': 0.9,

'R__max': 1,

'R_0': 1,

'seed': 189654913,

'theta_sell_min': 10,

'theta_sell_max': 100,

'theta_buy_min': 10,

'theta_buy_max': 100,

'theta_inc': 1,

'nPriceChangeInc': 50,

'priceDiscSet': '1, 0.5',

'run3D': False,

'price_disc_list': [1.0, 0.5]}def run_policy_evalu(piInfo_evalu, piName_evalu, stop_time_evalu):

model_copy = copy(M_evalu)

buyList = []

sellList = []

record = [] #.

for t in range(stop_time_evalu):

x_t = getattr(P_evalu, piName_evalu)(t, model_copy.S_t, piInfo_evalu, stop_time_evalu)

if x_t.x_t_GB > 0:

buyList.append((t, model_copy.S_t.p_t))

elif x_t.x_t_GB < 0:

sellList.append((t, model_copy.S_t.p_t))

res = model_copy.step(t, x_t) # step the model forward one iteration

# print(f'{res=}')

record.append([res[0].R_t, res[0].p_t, res[1], res[2].x_t_EL, res[2].x_t_EB, res[2].x_t_GL, res[2].x_t_GB, res[2].x_t_BL])

cumC = model_copy.cumC

return cumC, record# EVALUATION

piName_evalu = 'X__bellman'

stop_time_evalu = 1804.6.2.1 Optimal policy

piName_evalu'X__bellman'inc = 1.0

# inc = 0.5

discreteEnergy = np.array([0., 1.])

minPrice = np.min(exogParams['hist_price'])

maxPrice = np.max(exogParams['hist_price'])

discrete_prices = np.arange(minPrice, maxPrice + inc, inc)

bdp_2D_evalu = best_bdp

cumC, record = run_policy_evalu(bdp_2D_evalu, piName_evalu, stop_time_evalu=params['T'])

labels = ["R_t", "p_t", "cumC", 'x_t_EL', 'x_t_EB', 'x_t_GL', 'x_t_GB', 'x_t_BL']

print(f'{bdp_2D_evalu=}')

df = pd.DataFrame.from_records(data=record, columns=labels); df[:20]bdp_2D_evalu=<__main__.BDP object at 0x7f78e9412d30>| R_t | p_t | cumC | x_t_EL | x_t_EB | x_t_GL | x_t_GB | x_t_BL | |

|---|---|---|---|---|---|---|---|---|

| 0 | 0.0000 | 18.9100 | 17.0190 | 0 | 0 | 0 | -1.0000 | 0 |

| 1 | 0.0000 | 14.2700 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 2 | 0.0000 | 9.6700 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 3 | 0.0000 | 17.6800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 4 | 0.0000 | 11.8800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 5 | 0.0000 | 2.0800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 6 | 0.0000 | 0.0000 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 7 | 0.0000 | 18.0000 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 8 | 0.0000 | 14.4800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 9 | 0.0000 | 17.8800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 10 | 0.0000 | 24.6400 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 11 | 0.0000 | 19.5700 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 12 | 0.0000 | 20.2600 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 13 | 0.0000 | 22.2100 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 14 | 0.0000 | 18.5200 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 15 | 0.0000 | 18.7800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 16 | 0.0000 | 23.0900 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 17 | 0.0000 | 30.6900 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 18 | 0.0000 | 22.8800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 19 | 0.0000 | 24.6000 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

df.tail()| R_t | p_t | cumC | x_t_EL | x_t_EB | x_t_GL | x_t_GB | x_t_BL | |

|---|---|---|---|---|---|---|---|---|

| 187 | 1.0000 | 53.2500 | 58.3380 | 0 | 0 | 0 | 0.0000 | 0 |

| 188 | 1.0000 | 48.2300 | 58.3380 | 0 | 0 | 0 | 0.0000 | 0 |

| 189 | 1.0000 | 33.4200 | 58.3380 | 0 | 0 | 0 | 0.0000 | 0 |

| 190 | 1.0000 | 32.3800 | 58.3380 | 0 | 0 | 0 | 0.0000 | 0 |

| 191 | 0.0000 | 33.1900 | 87.4800 | 0 | 0 | 0 | -1.0000 | 0 |

4.6.2.2 Non-optimal policy

cumCI_inc_I{1.0: 87.48}piName_evalu = 'X__bellman_random'

bdp_2D_evalu = bdpI_inc_I[1.0]

cumC, record = run_policy_evalu(bdp_2D_evalu, piName_evalu, stop_time_evalu=params['T'])

labels = ["R_t", "p_t", "cumC", 'x_t_EL', 'x_t_EB', 'x_t_GL', 'x_t_GB', 'x_t_BL']

print(f'{bdp_2D_evalu=}')

df_non = pd.DataFrame.from_records(data=record, columns=labels); df_non[:20]bdp_2D_evalu=<__main__.BDP object at 0x7f78e9412d30>| R_t | p_t | cumC | x_t_EL | x_t_EB | x_t_GL | x_t_GB | x_t_BL | |

|---|---|---|---|---|---|---|---|---|

| 0 | 1.0000 | 18.9100 | 0.0000 | 0 | 0 | 0 | 0.0000 | 0 |

| 1 | 0.0000 | 14.2700 | 17.0190 | 0 | 0 | 0 | -1.0000 | 0 |

| 2 | 0.0000 | 9.6700 | 17.0190 | 0 | 0 | 0 | -0.0000 | 0 |

| 3 | 0.0000 | 17.6800 | 17.0190 | 0 | 0 | 0 | 0.0000 | 0 |

| 4 | 1.1111 | 11.8800 | -0.6610 | 0 | 0 | 0 | 1.1111 | 0 |

| 5 | 0.0000 | 2.0800 | 11.2190 | 0 | 0 | 0 | -1.1111 | 0 |

| 6 | 1.1111 | 0.0000 | 9.1390 | 0 | 0 | 0 | 1.1111 | 0 |

| 7 | 0.0000 | 18.0000 | 9.1390 | 0 | 0 | 0 | -1.1111 | 0 |

| 8 | 0.0000 | 14.4800 | 9.1390 | 0 | 0 | 0 | -0.0000 | 0 |

| 9 | 0.0000 | 17.8800 | 9.1390 | 0 | 0 | 0 | 0.0000 | 0 |

| 10 | 0.0000 | 24.6400 | 9.1390 | 0 | 0 | 0 | 0.0000 | 0 |

| 11 | 0.0000 | 19.5700 | 9.1390 | 0 | 0 | 0 | 0.0000 | 0 |

| 12 | 0.0000 | 20.2600 | 9.1390 | 0 | 0 | 0 | -0.0000 | 0 |

| 13 | 1.1111 | 22.2100 | -11.1210 | 0 | 0 | 0 | 1.1111 | 0 |

| 14 | 0.9877 | 18.5200 | -8.6532 | 0 | 0 | 0 | -0.1235 | 0 |

| 15 | 1.0014 | 18.7800 | -8.8819 | 0 | 0 | 0 | 0.0137 | 0 |

| 16 | 1.0014 | 23.0900 | -8.8819 | 0 | 0 | 0 | 0.0000 | 0 |

| 17 | 0.9998 | 30.6900 | -8.8502 | 0 | 0 | 0 | -0.0015 | 0 |

| 18 | 0.9998 | 22.8800 | -8.8502 | 0 | 0 | 0 | 0.0000 | 0 |

| 19 | 0.9998 | 24.6000 | -8.8502 | 0 | 0 | 0 | 0.0000 | 0 |

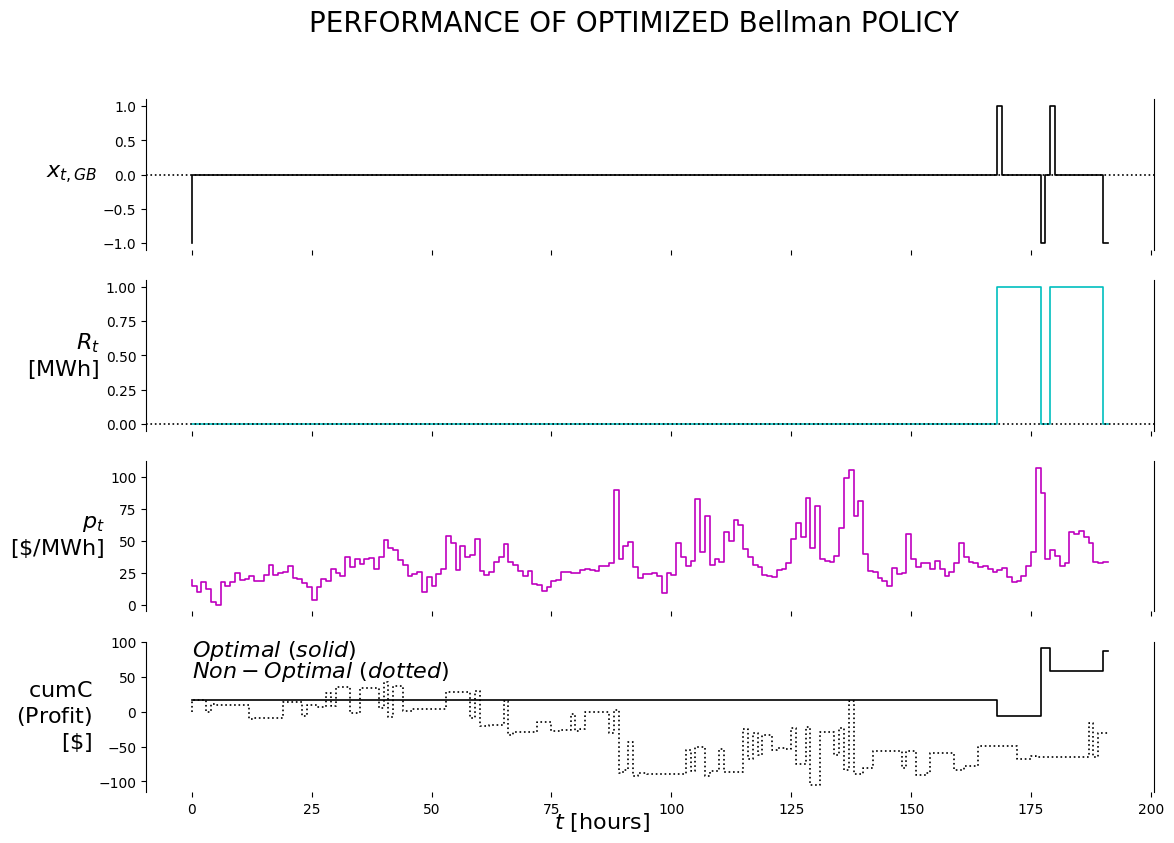

4.6.2.3 Visualization

from certifi.core import where

def plot_output(df1, df2):

n_charts = 4

ylabelsize = 16

mpl.rcParams['lines.linewidth'] = 1.2

fig, axs = plt.subplots(n_charts, sharex=True)

# fig.set_figwidth(50); fig.set_figheight(20)

fig.set_figwidth(13); fig.set_figheight(9)

fig.suptitle('PERFORMANCE OF OPTIMIZED Bellman POLICY', fontsize=20)

i = 0 #buy/hold/sell

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(False)

axs[i].step(df1['x_t_GB'], 'k')

axs[i].axhline(y=0, color='k', linestyle=':')

axs[i].set_ylabel('$x_{t,GB}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

i = 1 #R_t

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(False)

axs[i].step(df1['R_t'], 'c')

axs[i].axhline(y=0, color='k', linestyle=':')

axs[i].set_ylabel('$R_t$'+'\n'+'$\mathrm{[MWh]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

i = 2 #p_t

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(False)

axs[i].step(df1['p_t'], 'm')

# axs[i].axhline(y=theta_evalu[0], color='m', linestyle=':')

# axs[i].text(0, theta_evalu[0], r'$\theta^{buy}$', size=16)

# axs[i].axhline(y=theta_evalu[1], color='m', linestyle='--')

# axs[i].text(0, theta_evalu[1], r'$\theta^{sell}$', size=16)

axs[i].set_ylabel('$p_t$'+'\n'+'$\mathrm{[\$/MWh]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

i = 3 #cumC

axs[i].set_ylim(auto=True); axs[i].spines['top'].set_visible(False); axs[i].spines['right'].set_visible(True); axs[i].spines['bottom'].set_visible(False)

axs[i].step(df1['cumC'], 'k')

axs[i].step(df2['cumC'], 'k:')

axs[i].text(0, 80, r'$Optimal\ (solid)$', size=16)

axs[i].text(0, 50, r'$Non-Optimal\ (dotted)$', size=16)

axs[i].set_ylabel('$\mathrm{cumC}$'+'\n'+'$\mathrm{(Profit)}$'+'\n'+''+'$\mathrm{[\$]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

axs[i].set_xlabel('$t\ \mathrm{[hours]}$', rotation=0, ha='right', va='center', fontweight='bold', size=ylabelsize);

plot_output(df, df_non)